News Date: June 1, 2024

https://gesara.news/petro-dollar-end/

In June 2024, Saudi Arabia is expected to announce that it will cease all oil sales in US dollars, marking the end of the 50-year Petrodollar Pact signed on June 6, 1974, which expires on June 9, 2024.

The decision not to renew this pact stems from Saudi Arabia's recent invitation to BRICS and its move towards dedollarization.

Crown Prince Mohammed bin Salman has informed the Saudi government that the country will no longer accept US dollars for oil transactions.

This shift includes considerations to accept other currencies, such as the Chinese yuan, for oil sales, as reported by the Wall Street Journal on March 15, 2022.

Best Stimulus Package

Trump Promises Best Stimulus Package You Have Ever Seen, After Election. Trumps announcement put his stamp of approval on a new timetable that came to the fore earlier in the day after Senators left Washington, D.C., for a pre-election break.

Sources: www.newsmax.com

Donald Trump nationalized the Federal Reserve?

Fed and Treasury to Merge?

The federal government is nationalizing large swaths of the financial markets. The Fed is providing the money to do it. BlackRock will be doing the trades. This scheme essentially merges the Fed and Treasury into one organization. So, meet your new Fed chairman, Donald J. Trump.

Source:finance.yahoo.com

Chinese, Russian payment systems consultations

Chinese and Russian central banks to discuss the use of national payment systems.

The Chinese and Russian central banks will discuss the use and promotion of their respective national payment systems in both countries, Beijing's envoy to Moscow told the TASS news agency in an interview published on Thursday.

Russian banks may issue cards with China as Visa, and Mastercard cut links.

The use of the Mir and China UnionPay national payment systems in both countries will be decided by the two sides' central banks at consultations.

Sources: reuters.com

A comprehensive guide to Precious Metals

A comprehensive guide to Precious Metals. It is easy to understand. Even beginners can use it to learn about mining, what factors move prices, and how trading works.

The guide includes:

> Why Are Metals Important?

> What Are the Different Types of Metals?

> Main Uses of Metals?

> What are the Main Global Metals Trends?

> Top Metals Producing Countries?

> Top Precious Metal Indices?

> What Are The Top Metals Investment Resources?

> Where to Trade Metals?

You can learn more here: commodity.com

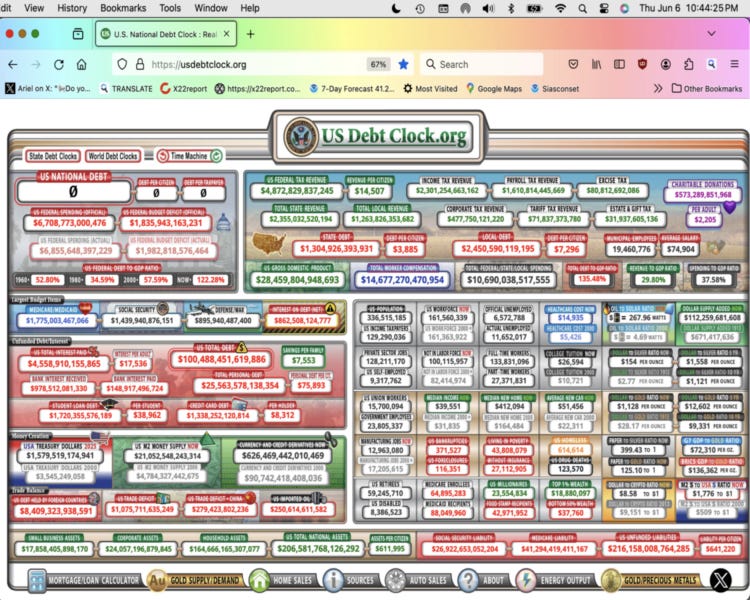

Thank you for the post. What do you think the ramifications of the end of the petro-dollar agreement will be? Hyperinflation? The death of the US dollar? Skyrocketing precious metals prices? I have heard this called a black swan event. Your thoughts, please.